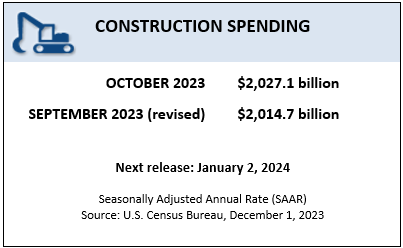

According to the U.S. Census Bureau, construction spending during October 2023 was estimated at a seasonally adjusted annual rate of $2,027.1 billion, 0.6% (±1.0%) above the revised September estimate of $2,014.7 billion. The October figure is 10.7% (±1.6%) above the October 2022 estimate of $1,830.5 billion. During the first 10 months of this year, construction spending amounted to $1,646.0 billion, 5.6% (±1.2%) above the $1,559.1 billion for the same period in 2022.

In October, the estimated seasonally adjusted annual rate of public construction spending was $447.8 billion, 0.2% (±2.0%) above the revised September estimate of $446.9 billion.

- Highway construction was at a seasonally adjusted annual rate of $132.0 billion, 0.3% (±4.8%) below the revised September estimate of $132.4 billion.

- Educational construction was at a seasonally adjusted annual rate of $97.2 billion, 0.4% (±2.3%) above the revised September estimate of $96.7 billion.

Spending on private construction was at a seasonally adjusted annual rate of $1,579.3 billion, 0.7% (±0.8%) above the revised September estimate of $1,567.9 billion.

- Residential construction was at a seasonally adjusted annual rate of $884.4 billion in October, 1.2% (±1.3%) above the revised September estimate of $873.6 billion.

- Nonresidential construction was at a seasonally adjusted annual rate of $694.8 billion in October, 0.1% (±0.8%) above the revised September estimate of $694.2 billion.

“It is apparent that the construction market overall remains healthy,” said Ken Simonson, Associated General Contractors of America chief economist. “But a rotation is occurring among nonresidential segments as manufacturing construction expands while commercial construction slumps and highway and street spending stagnates. On the residential side, single-family construction is picking up, while multifamily is descending from record highs.”

“Nonresidential construction spending increased for the 16th consecutive month in October and is now up an even 20% over the past year,” said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. “As has been the case, more than 45% of that year-over-year increase is due to surging construction activity in the manufacturing sector, though infrastructure-related categories like highway and street and sewage and waste disposal have also outperformed.

“Spending in the commercial category, which includes construction of distribution and warehouse space, fell sharply in October,” said Basu. “This is likely due to a severe slowdown in the freight industry and slowing warehouse-related construction rather than a sudden decline in retail-related construction. Despite weakness in the commercial category and other headwinds like high interest rates and labor shortages, contractors remain optimistic about their sales over the next six months, according to ABC’s Construction Confidence Index.”